sancastle realty's Blog

Our Blog Articles

Florida Homeowners Insurance: Your Complete Guide for 2025

Introduction

For Florida homeowners, 2025 brings new challenges and updates in insurance, especially with rising premiums due to increased hurricane activity and heightened insurance regulations. This guide covers everything homeowners in Florida need to know about navigating the insurance landscape in 2025.

1. Why Homeowners Insurance is Essential in Florida

Weather Risks Intensify in 2025

Florida’s exposure to severe weather events, including hurricanes and flooding, remains one of the highest in the U.S. The Federal Emergency Management Agency (FEMA) projects continued flooding risks, and with 2025’s updated insurance regulations, robust coverage is vital.

Lender Requirements

While insurance isn’t legally required in Florida, mortgage lenders mandate it, meaning most homeowners must carry coverage.

2. What’s Covered in a 2025 Florida Homeowners Insurance Policy?

Policies generally cover:

Dwelling Protection: From hurricanes to fires, covering structural damage.

Personal Property: Furniture, electronics, and other belongings.

Liability Insurance: Financial support for accidents on your property.

Additional Living Expenses (ALE): Supports temporary housing if repairs are needed.

Flood insurance remains separate and essential for many residents in high-risk areas.

3. Specialized Coverage for Florida’s Risks

Hurricane and Windstorm Deductibles

With 2025’s anticipated increase in storm frequency, most policies include special deductibles for hurricane damage, typically a percentage of the insured value.

Flood Insurance

Flooding remains a significant risk, especially near Florida’s coastlines. Homeowners in FEMA-designated high-risk zones may need separate flood policies through the National Flood Insurance Program (NFIP) or private insurers.

Sinkhole Coverage

Standard policies cover catastrophic ground collapse, but full sinkhole protection may require an add-on.

4. Average Insurance Costs in Florida (2025)

Florida continues to have the highest insurance rates in the U.S., with the average premium rising to around $3,800 annually. Factors affecting this include:

Coastal Exposure: Properties along the coastline see higher premiums.

Older Homes: Properties lacking wind-resistant updates face added costs.

Coverage Choices: Higher limits for personal property or ALE increase premiums.

To reduce costs, consider wind mitigation upgrades or increasing your deductible.

5. Choosing the Right Insurance Policy in Florida

Assess Risks Thoroughly

Evaluate risks based on location, including flood and hurricane zones.

Compare Quotes Across Providers

With rising rates in 2025, comparing quotes from at least three reputable insurers can save money.

Annual Policy Reviews

Review your coverage yearly to ensure it remains adequate for changes in risk and regulation.

6. Common Questions About Florida Homeowners Insurance in 2025

What if Insurance Becomes Unaffordable?

Citizens Property Insurance Corporation offers coverage for homeowners unable to secure affordable private insurance.Are Discounts Available?

Yes, for wind mitigation upgrades, bundling policies, and security features.Can I Switch Insurers?

Florida allows you to switch insurance providers mid-term, which can help you secure better rates.

7. How to File a Claim Effectively

Document Promptly: Take photos or videos immediately following damage.

Communicate with the Adjuster: Work closely with adjusters to ensure fair assessments.

Appeal if Needed: Dispute decisions if they seem unfair, especially with large claims.

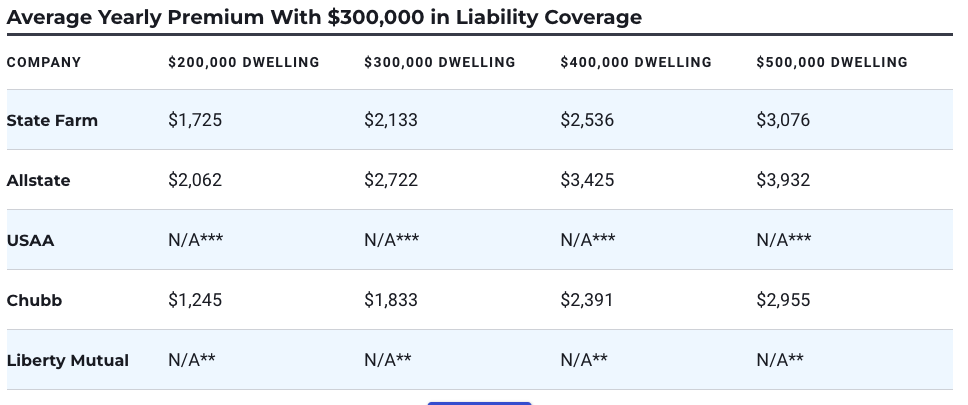

8. Top Insurers in Florida for 2025

Consider reputable providers offering specialized Florida coverage, such as:

State Farm: Comprehensive hurricane options and customer service.

Allstate: Flood insurance add-ons and extensive discounts.

Progressive: Competitive rates for bundled policies.

Citizens Property Insurance: For homeowners in high-risk zones needing last-resort coverage.

Conclusion: Stay Informed and Protected in 2025

With rising risks and evolving policies, understanding homeowners insurance in Florida is critical in 2025. Regularly review coverage, compare quotes, and take advantage of available discounts to keep your property protected. Being proactive with insurance choices will ensure peace of mind as Florida faces another year of weather unpredictability.

Protect your Florida home with the right coverage! We at Sancastle Realty can help you connect with expert insurance agents who specialize in safeguarding Florida properties. Our team at Sancastle Realty will help guide you to the best options for your needs, ensuring peace of mind no matter what the weather brings. Reach out now to get started on securing the perfect coverage!