Understanding Market Appreciation in Rentals: How It Impacts Your Investment Returns

Introduction

When investing in rental properties, one of the key factors that contributes to long-term wealth generation is market appreciation. While many investors focus on rental income as the primary source of cash flow, the appreciation of property values over time can significantly boost your overall return on investment (ROI). Understanding how market appreciation works, how to calculate it, and how it fits into your investment strategy is crucial to maximizing your rental property profits.

In this guide, we’ll explain the concept of market appreciation, the factors that influence it, and how it impacts rental property investments. We’ll also discuss ways to identify properties with strong appreciation potential and how to balance appreciation with cash flow for optimal investment returns.

What is Market Appreciation?

Market appreciation refers to the increase in the value of a property over time due to market factors, such as increased demand, economic growth, or improvements in the neighborhood. In real estate, appreciation can occur naturally as property values rise, or it can be accelerated by property improvements or favorable economic conditions.

Types of Appreciation:

Natural Appreciation: This happens when the value of the property increases over time due to market conditions such as population growth, urban development, or inflation.

Forced Appreciation: This occurs when the property owner actively increases the property’s value through renovations or upgrades (e.g., adding a new bathroom or modernizing the kitchen).

Both types of appreciation play a critical role in increasing the equity of a property and contributing to long-term profits when the property is sold or refinanced.

How to Calculate Market Appreciation

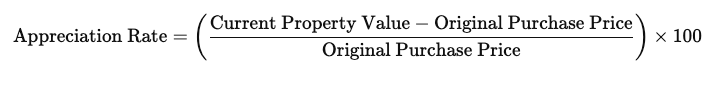

Calculating market appreciation helps investors understand how much value their property has gained over time. Here’s a basic formula for calculating appreciation:

For example, if you purchased a rental property for $200,000 and it is now worth $250,000, the appreciation rate would be:

This means your property has appreciated by 25% since you purchased it. The higher the appreciation rate, the more value your property has gained over time.

Factors That Drive Market Appreciation

Several factors influence the rate at which a property appreciates. By understanding these factors, you can make more informed decisions when selecting rental properties with strong appreciation potential.

1. Location

The location of a property is the most important factor in determining its appreciation potential. Properties in areas with high population growth, job opportunities, and amenities tend to appreciate faster. For example, cities like Miami and Orlando have seen strong appreciation due to their growing populations and thriving economies.

2. Economic Conditions

A strong local or national economy can lead to rising property values as more people move into an area and demand for housing increases. Economic factors such as employment rates, income growth, and consumer confidence also impact appreciation.

3. Infrastructure Development

New infrastructure projects, such as the construction of highways, public transportation, schools, or shopping centers, can significantly boost property values in an area. Properties located near new developments often see faster appreciation as demand increases.

4. Supply and Demand

When there’s limited supply but high demand for rental properties in a particular area, home prices tend to rise more quickly. Investors should look for neighborhoods with limited housing supply and increasing demand to capitalize on market appreciation.

5. Inflation

As inflation rises, the cost of construction materials and real estate increases. This leads to higher home prices, which boosts the nominal value of rental properties. Even though inflation erodes purchasing power, it can cause property values to increase over time.

Learn More: Best Cities in Florida for Rental Property Investments

How Market Appreciation Affects Rental Property Investments

1. Increased Equity

As your property appreciates, you build equity—the difference between your property’s current value and the balance on your mortgage. Increased equity allows you to refinance, take out a home equity loan, or sell the property at a profit.

2. Higher Rental Rates

In markets where property values are rising, rental rates often increase as well. As the cost of homeownership rises, more people choose to rent, leading to higher demand and allowing landlords to charge more for rent. This results in both increased rental income and long-term appreciation gains.

3. Wealth Accumulation Over Time

Over the long term, market appreciation allows investors to accumulate wealth through property value increases. When combined with rental income, the compounded growth of appreciation can create significant wealth over several years, especially if the property is held for the long term.

4. Leverage and ROI

If you’ve used financing to purchase the property, appreciation can significantly boost your return on investment (ROI). For example, if you put down 20% on a $300,000 property (investing $60,000), and the property appreciates by 10% ($30,000), that represents a 50% return on your original investment, thanks to leverage.

Learn More: Financing Options for Rental Properties

Balancing Cash Flow and Appreciation

While market appreciation can lead to significant long-term gains, it’s essential to balance appreciation with cash flow. Cash flow refers to the monthly rental income you generate after accounting for all expenses, such as mortgage payments, property taxes, and maintenance.

High-Appreciation Markets

Properties in high-appreciation markets may offer lower cash flow but greater long-term wealth accumulation through rising property values. For example, an investment property in Miami may offer modest monthly cash flow but appreciate significantly over several years due to high demand and limited supply.

High-Cash-Flow Markets

On the other hand, properties in lower-appreciation markets may generate higher monthly cash flow, but their value may not increase as rapidly. These markets are ideal for investors looking for steady income rather than long-term property value growth.

To create a well-balanced real estate portfolio, many investors aim to invest in both high-cash-flow and high-appreciation markets. This approach ensures they can enjoy consistent cash flow while benefiting from long-term appreciation.

Learn More: How to Evaluate Rental Property Cash Flow

Strategies for Maximizing Market Appreciation

1. Invest in Emerging Markets

Identifying and investing in emerging markets that show signs of future growth can lead to significant appreciation. Look for areas with strong job growth, population increases, and infrastructure development.

2. Add Value Through Renovations

Forced appreciation through renovations is an excellent way to increase property value. Renovating kitchens, bathrooms, and exterior landscaping can make a property more appealing and valuable, leading to higher resale values and rental income.

3. Hold Properties Long-Term

Appreciation works best over the long term. Real estate values tend to increase over decades, and holding properties for longer periods allows you to maximize the appreciation gains while enjoying steady rental income.

Conclusion

Market appreciation is a powerful tool for growing your wealth as a rental property investor. While cash flow is critical for maintaining your investment in the short term, appreciation can significantly boost your profits over the long term. By understanding the factors that drive appreciation and identifying the right markets, you can create a well-balanced investment strategy that maximizes both rental income and property value growth.

At Sancastle Realty, we specialize in helping investors identify properties with strong appreciation potential. Whether you're looking for high-cash-flow properties or long-term appreciation, our team of experts can guide you through every step of the investment process. Contact Sancastle Realty today to find your next profitable rental property in a high-growth market.