Short-Term vs Long-Term Rentals: Choosing the Best Strategy for Your Investment

Introduction

As a real estate investor, deciding whether to pursue short-term or long-term rentals can significantly impact your cash flow, management approach, and overall success. Each rental strategy comes with its own advantages and challenges, depending on your investment goals, target market, and property location.

In this guide, we’ll break down the differences between short-term and long-term rental strategies, explore the pros and cons of each, and help you determine which option is best suited for your investment property. Whether you're looking for higher income potential or greater stability, understanding these two rental models will help you make informed decisions and maximize your returns.

What Are Short-Term Rentals?

Short-term rentals (STRs) are typically rented out for periods ranging from a few days to several months. These properties are commonly found on platforms like Airbnb, VRBO, and Booking.com. Popular among tourists, vacationers, and business travelers, short-term rentals offer flexibility for property owners to adjust pricing and availability based on demand.

Common Types of Short-Term Rentals:

Vacation Homes: Properties in tourist destinations rented for short stays (e.g., beach houses, mountain cabins).

Business Accommodations: Rentals near business hubs that serve traveling professionals.

Urban Apartments: City-center apartments catering to tourists or professionals looking for temporary accommodations.

What Are Long-Term Rentals?

Long-term rentals are leased to tenants for extended periods, usually six months to a year or more. These rentals cater to residents looking for a stable place to live and are typically governed by a lease agreement that outlines rent terms, responsibilities, and maintenance requirements.

Common Types of Long-Term Rentals:

Single-Family Homes: Standalone homes rented to individuals or families for extended stays.

Multifamily Properties: Apartments or duplexes rented to long-term tenants.

Condos: Units in condominium complexes leased for residential use.

Pros and Cons of Short-Term Rentals

Pros

Higher Income Potential Short-term rentals often generate higher nightly rates compared to long-term leases, especially in popular tourist destinations or areas with high demand. For example, a beachfront property in Miami could command $200 per night as a short-term rental, compared to $2,500 per month as a long-term rental.

Flexibility As the property owner, you have more control over availability and can adjust rental prices based on peak seasons or demand. This flexibility allows you to optimize your income and even block off time for personal use.

Diversified Tenant Base Short-term rentals typically attract a variety of guests, reducing the likelihood of dealing with a difficult long-term tenant. Since guests stay for only a short period, there’s less risk of tenant disputes or legal complications.

Cons

High Turnover and Vacancy Risk Short-term rentals have much higher tenant turnover, which can lead to periods of vacancy. Additionally, securing bookings requires consistent marketing, competitive pricing, and maintaining a presence on platforms like Airbnb.

More Management and Maintenance Frequent guest turnover means more cleaning, maintenance, and management. You'll need to prepare the property for each new guest, often requiring professional cleaning services and regular upkeep.

Regulatory Restrictions Many cities and homeowners’ associations (HOAs) have strict regulations or outright bans on short-term rentals. Ensure that you research local laws before pursuing this strategy to avoid legal complications.

Learn More: HOAs and Rental Properties in Florida

Pros and Cons of Long-Term Rentals

Pros

Stable and Predictable Income Long-term rentals offer consistent monthly income over extended periods. With a reliable tenant in place, you can expect regular rent payments and fewer concerns about vacancies, making cash flow more predictable.

Lower Management Costs Long-term rentals require less hands-on management compared to short-term rentals. With a longer lease, landlords are not constantly dealing with turnover, check-ins, and cleanings.

Easier Financing Many lenders prefer financing long-term rentals over short-term investments because they are viewed as lower-risk. As a result, you may qualify for better mortgage rates and terms when purchasing a long-term rental property.

Cons

Lower Income Potential While long-term rentals offer stability, the income potential is often lower than what could be earned from a short-term rental, particularly in high-demand markets. For example, a long-term tenant may pay $1,800 per month for a property that could earn $4,500 per month as a short-term rental during peak season.

Limited Flexibility Once a long-term lease is signed, you lose flexibility. Rent increases can only occur at the end of a lease term, and you can't easily decide to use the property for personal purposes.

Tenant Risks With a long-term lease, the success of your rental depends heavily on the quality of your tenant. Screening tenants thoroughly is essential to ensure that you avoid potential issues such as non-payment, property damage, or eviction.

Learn More: How to Screen Tenants for Your Rental Property

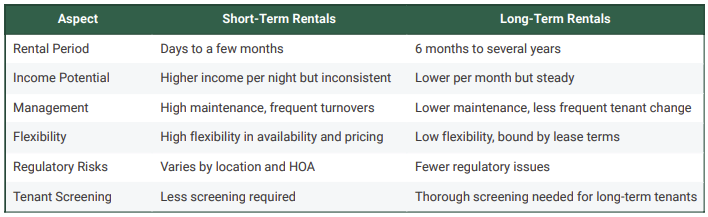

Short-Term vs Long-Term Rentals: Key Differences

Key Considerations for Choosing a Strategy

1. Location and Demand

The location of your property plays a crucial role in determining which rental strategy is best. In high-tourism areas like Miami, Orlando, or Tampa, short-term rentals may be more profitable due to high visitor demand. Conversely, in suburban areas or regions with strong year-round demand for housing, long-term rentals may provide more consistent cash flow.

2. Local Regulations

Before deciding on short-term or long-term rentals, review your local laws and any homeowners’ association (HOA) rules. Some cities heavily regulate or restrict short-term rentals, requiring licenses, occupancy taxes, and compliance with safety standards.

3. Time and Effort Involved

Short-term rentals require more active management, including guest communication, maintenance, and marketing. If you prefer a more hands-off investment, long-term rentals may be better suited to your lifestyle, especially if you plan to self-manage the property.

4. Risk Tolerance

With short-term rentals, you face more uncertainty due to fluctuations in demand, especially during off-peak seasons. Long-term rentals, on the other hand, offer stability and less income variability, making them a lower-risk investment.

Conclusion

Choosing between short-term and long-term rentals depends on your financial goals, property location, and willingness to manage the property. Short-term rentals offer the potential for higher income, but come with more management responsibilities and regulatory concerns. Long-term rentals provide more stability and less turnover, making them ideal for investors seeking steady cash flow and fewer operational demands.

At Sancastle Realty, we help investors identify the best rental strategy based on their property and goals. Whether you’re considering a vacation rental or a traditional long-term lease, our team can guide you through the decision-making process and help you maximize your returns. Contact Sancastle Realty today to find out how we can assist you in choosing the right investment approach for your rental property.